We, Unitlab AI, raised $200K from IT Park Ventures and $200K Aloqa Ventures, $400K in total, in the on-going Seed round for growth in March 2025 alone. It is a notable milestone for us to receive venture capital to scale our operations and sales.

By raising capital in on-going Seed, we achieved a major stepping stone for our startup. This event signifies that Unitlab AI, an automated data annotation platform, has progressed beyond a mere working prototype to a stage where investors see genuine promise in our product, team, and market potential. The Seed capital not only provides the necessary funds for us to continue developing our platform and expand our market, but also validates our high-growth potential.

However, this outstanding achievement carries many implications that may not be obvious to an outside observer. What does it mean for an early startup to secure Seed funding from a VC?

Our VC Investors

Aloqa Ventures

Founded in 2021 by Aloqabank, Aloqa Ventures is a venture capital firm with a keen focus on innovative, promising startups in the fields of Smart Tech, E-commerce, FinTech, AI, and others. With a portfolio comprising more than 30 startups, Aloqa Ventures provides pre-seed and seed funding of $50,000 to $250,000, as well as technical expertise and market integration support.

IT PARK Ventures

IT PARK Ventures is a venture capital fund backed by the Uzbek government that provides funding and market expertise to early-stage startups. With $10 million fund capitalization, IT PARK Ventures invests, on average, $150K in a promising startup to assist it in scaling operations and entering the international market.

So, why is it a "big deal" for a startup to receive venture capital? Why do startups rightly celebrate this occasion?

Extreme Competition for Venture Capital

Startup Quest for VC Funding

Although the global startup ecosystem and funding opportunities have expanded over the last two decades, competition for venture capital remains fiercer than ever. With the AI and cryptocurrency boom over the past five years, countless startups compete for the limited resources required to drive product development and market expansion.

Every year, thousands of startups apply for venture capital funding, yet fewer than 1% end up receiving it. In the case of IT PARK Ventures, after a long and rigorous selection process, Unitlab AI and two other startups were chosen from more than 100 companies.

The reason behind such stiff competition is not just about large sums of money. Venture capital firms also offer startups access to global partners, new markets, and expert advisors. Early-stage companies vie intensely for these opportunities, intensifying the overall battle for capital.

Power Law

Startups are inherently high-risk, high-reward investments. In pursuit of maximizing returns on this risk, venture capitalists conduct meticulous research into companies, markets, and growth potential before selecting a handful of startups to invest in. A large pool of ventures seeking funding, combined with rigorous scrutiny, means only the top contenders ultimately receive capital.

As Peter Thiel describes in Zero to One, venture capital follows a power law distribution: a tiny fraction of startups is responsible for the majority of returns. This explains why VCs aggressively pursue “unicorns” (startups valued at over $1 billion); missing out on a breakthrough success can mean losing out on massive gains. As a result, venture capitalists are extremely selective, focusing on a small number of high-growth prospects, unlike more traditional funds diversifying across many average companies.

This approach is justified by the numbers: in the US, less than 1% of startups receive venture capital, and total VC investments comprise less than 0.2% of GDP. However, their effect is disproportionate: VC-backed companies create 11% of all private sector jobs; they generate annual revenues equal to an outstanding 21% of the US GDP; in fact, the dozen largest tech companies (Apple, Google, Amazon, and others) were all venture backed. Together, these companies are worth more than all other tech companies combined.

Such a focus on finding “unicorns” intensifies competition not only among startups, but also among venture capital funds themselves.

Topping Competition

To secure funding in this environment, founders must show venture capitalists that their startups stand out amid countless innovative ideas. Yet simply being distinctive is not enough; they must also demonstrate a proven ability to scale and produce strong returns. Typically, the best-funded startups nail these essential points:

- Team and Vision – VCs often cite the strength, passion, and expertise of a founding team as a top predictor of success. In our case, Unitlab AI is run by a dedicated group of engineers led by a world-class AI engineer. Our vision is to build the most efficient platform for data annotation, collection, management, and user collaboration to streamline AI/ML development to accelerate the data annotation process by 15 times and cut costs fivefold, saving up to 60% of AI/ML engineers' time.

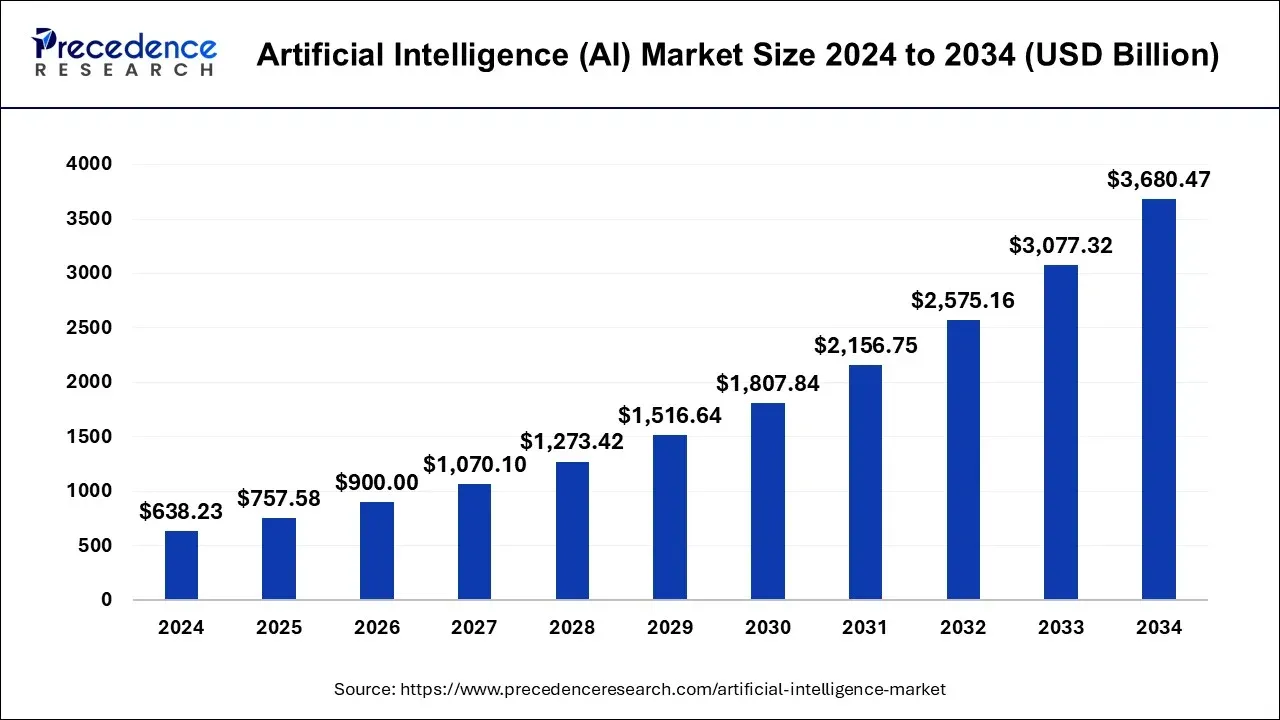

- Market Opportunity – Early-stage companies tackling significant problems in large, expanding industries attract more investor attention. Our platform, Unitlab Annotate, helps prepare and label datasets for various AI/ML models, particularly in computer vision. Since our work targets the high-growth AI sector (projected to expand at 19.2% annually from 2025 to 2034), Unitlab AI not only secured IT Park Ventures’ support but also backing from 500 Global and Startup Wise Guys.

Thanks to our strong team, clear vision, growth potential, and partnerships with other venture firms, we were able to stand out and secure $400K in on-going Seed from IT PARK and Aloqa Ventures. This capital enables us to propel growth, product development, and market expansion.

Conclusion

By nature, venture capital is highly competitive for both startups and investors. Venture funds look for game-changing ventures to support, while startups must prove their worth to gain that support. Securing venture capital in this environment is a significant achievement and a major milestone for any early-stage company.

At Unitlab AI, raising $400K in our Seed round from IT PARK and Aloqa Ventures confirms our company’s viability, growth potential, and the trust placed in our team. Although $400K may seem a small investment in the broader realm of venture capital, it provides the crucial resources we need to further refine our data annotation platform and business model. With this foundation, we can pursue larger rounds of funding as we continue to grow.

Explore More

- Aloqa Ventures Discover how this fund is advancing bright technological boundaries in Uzbekistan and beyond.

- IT Park Ventures: Discover their investment strategy, portfolio, and the value they bring to Uzbekistan’s growing startup ecosystem.

- Zero to One: Gain insights into scaling and the mindset required to transform early-stage startups into tech giants.

- Unitlab AI:

References

- Aloqa Ventures (March 18, 2025). AloqaVentures invested $200 000 in Unitlab. AloqaVentures News: Source

- Diane Mulcahy (May 2013). Six Myths About Venture Capitalists. Harvard Business Review: Source

- IT Park Ventures (Mar 11, 2025). IT Park Ventures: The First Venture Investments in Uzbekistan’s Startups. IT Park Ventures: Source

- Peter Thiel and Blake Masters (Sep 16, 2014). Zero to One: Notes on Startups, or How to Build the Future. Crown Currency: Source