We have written extensively about the use cases of Computer Vision in the real, practical world. We have covered healthcare, logistics, inventory management, among other industries. In this post, we are going to look at one of the biggest and most important industries that affects literally everyone on the planet - insurance.

Computer Vision Use Cases | Unitlab Annotate

The global insurance industry is enormous—projected to generate about $8.21 trillion in annual premiums by 2025—and employs millions of people worldwide. Because of the premiums it collects, the funds it invests, and its essential role in everyday life, insurance is a core pillar of the global economy. Every car must carry coverage, and roughly 92 percent of U.S. residents held some form of health-insurance policies in 2023.

Despite its scale, much day-to-day work in insurance still relies on manual inspections, paper documents, and subjective judgment. A one-percent cost reduction translates into millions of dollars in savings, so it is unsurprising that a wave of InsurTech start-ups is applying advanced algorithms and AI to modernize operations.

Among these technologies, computer vision (CV) stands out. By enabling software to see and interpret what underwriters and adjusters once assessed by eye, CV helps insurers shorten cycle times, reduce fraud, and price risk more accurately. McKinsey estimates that AI—including CV—could unlock more than $1.1 trillion a year for the insurance sector, with the greatest gains in marketing, sales, and risk management.

What is Insurance, Anyways?

Technically, there are two broad categories of insurance: conventional, for-profit insurance and Islamic takaful, a fast-growing, risk-sharing model worth about $36.6 billion globally in 2024. This post focuses on the conventional segment most people are familiar with.

At its core, insurance is organised risk transfer. A policyholder shifts the financial burden of potential losses—such as a car accident, a house fire, illness, or death—to an insurer in exchange for a premium. Premiums reflect the underlying risk; insurers pool these funds and invest them, paying out when covered events occur. For insurance companies, assessing and pricing the risk is the ultimate factor in their survival.

Key functions include:

- Underwriting – analysing risk exposure and setting an appropriate premium

- Policy servicing – issuing documents, collecting premiums, and managing renewals

- Claims – verifying legitimate losses, preventing fraud, and paying promptly and accurately

Each stage generates extensive textual and visual data: historical records and property photos for underwriting, and crash images, drone footage, handwritten forms, and CCTV clips for claims.

Computer Vision in Insurance

Computer vision is expanding rapidly; the global market is valued at nearly $30 billion for 2025 and is growing about 16 percent annually. According to McKinsey, the insurance sector stands to benefit significantly. Below are seven prominent CV use cases:

1. Instant Claims for Cars and Homes

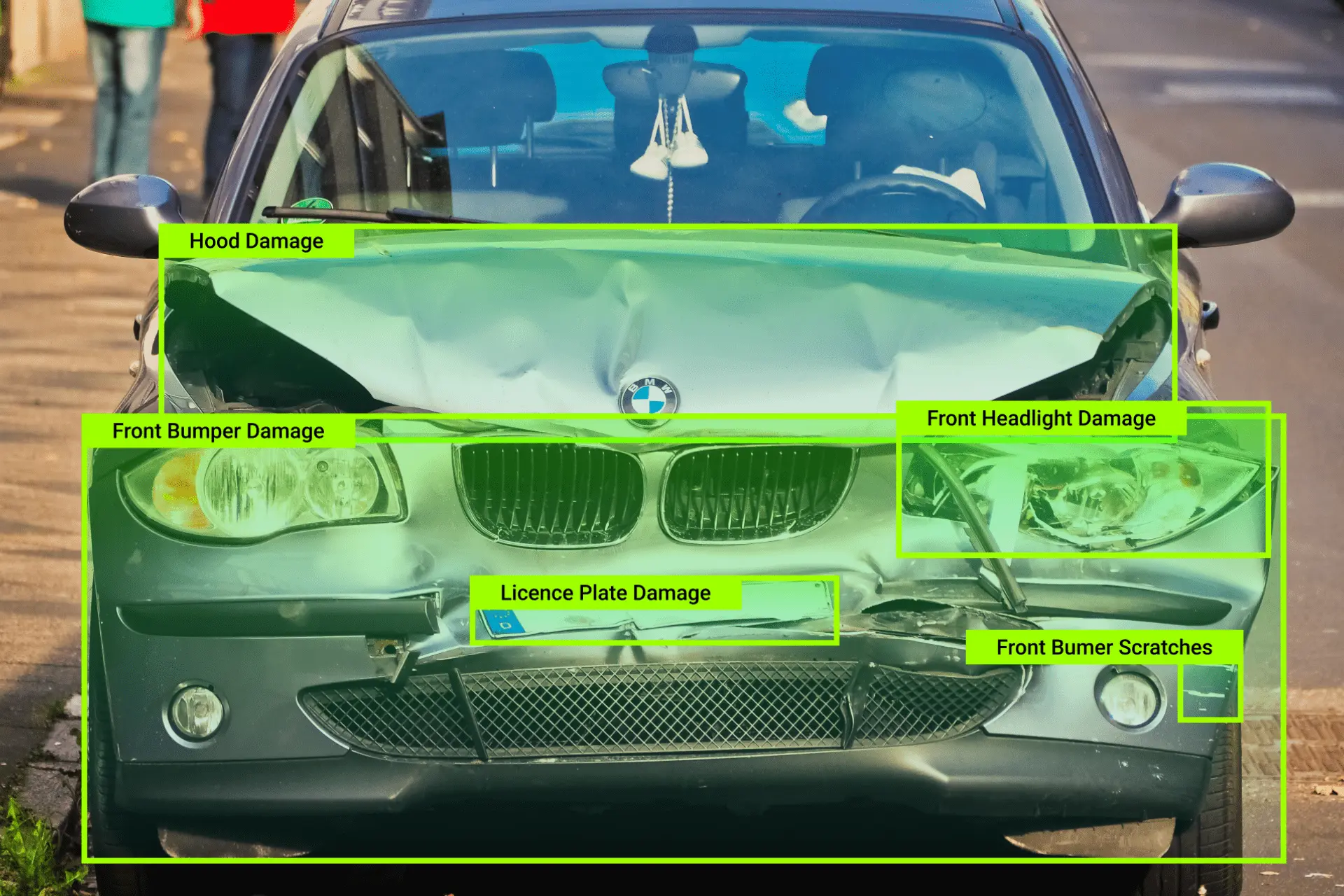

A decade ago, filing a claim for a cracked bumper meant waiting days—sometimes weeks—for an adjuster to arrive, photograph the damage, and negotiate a repair shop’s quote. CV collapses that timeline.

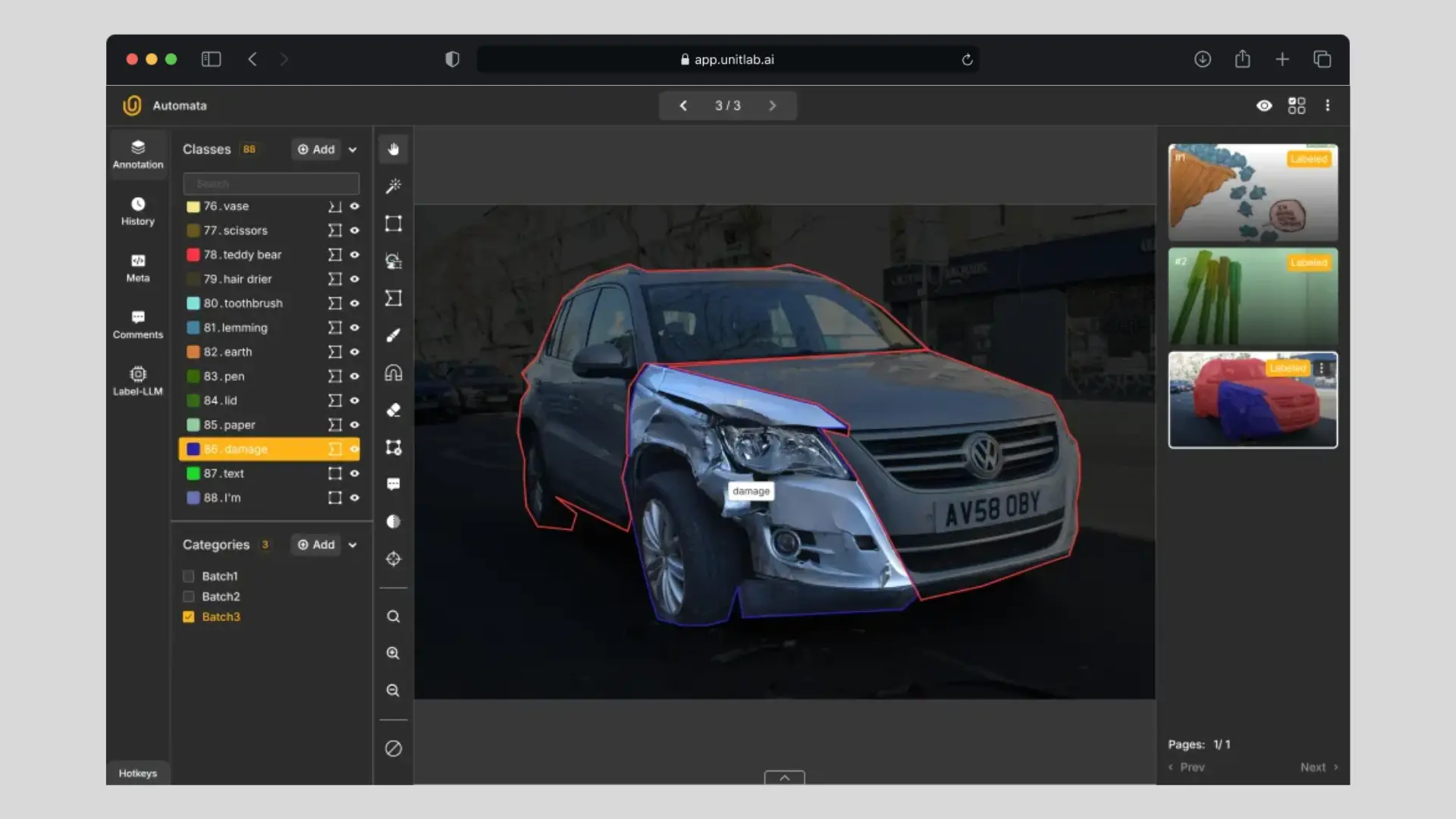

CV models trained on massive datasets of damaged cars and homes can accurately detect and classify damages. Researchers trained a YOLOv5 computer vision model to detect car damages, which worked extremely well for most common damages. Smartphone photos of a dented bumper or a burst pipe feed a model that identifies damage, estimates repair cost, and checks plausibility. If the driver’s images look suspicious—say, the background geometry does not match between frames—the workflow flags them for human review.

This is essentially what Tractable, a successful InsurTech, does in a nutshell. In 2023 alone, they processed more than $7 billion in annualized auto and home repairs and acquisitions with AI and CV models.

2. Safer, Faster Adjudication with Drones

Property-damage adjusters are four times more likely to be injured than U.S. construction workers. They climb shaky ladders, stand on fragile roofs, and squeeze into awkward corners—risking both personal safety and costly downtime.

High-resolution drones equipped with RGB cameras and LiDAR now handle that legwork. A single flight captures roof or wildfire damage in minutes; computer-vision models then segment shingles, measure impact craters, and flag structural hazards. The adjuster stays on the ground, reviewing calibrated 3-D imagery and prioritizing large-loss claims within hours of a storm. The result is faster triage, lower injury risk, and less business interruption—a clear example of AI enhancing, rather than replacing, human expertise.

Fintech OCR | Unitlab Annotate

3. OCR-Powered Document Intake

Despite its size, the insurance industry still runs on paper. Hand-written claim forms, repair invoices, and medical bills all require manual data entry—a slow, error-prone process.

Optical Character Recognition (OCR) has long helped digitize text, but pairing it with modern CV models elevates performance. Layout analysis separates tables, paragraphs, and signatures; entity recognition pulls dates, provider names, and tax IDs; tamper-detection flags inconsistent fonts or spliced images. End-to-end automation can trim data-entry costs by up to 80 percent, streamlining KYC, KYB, and other compliance workflows.

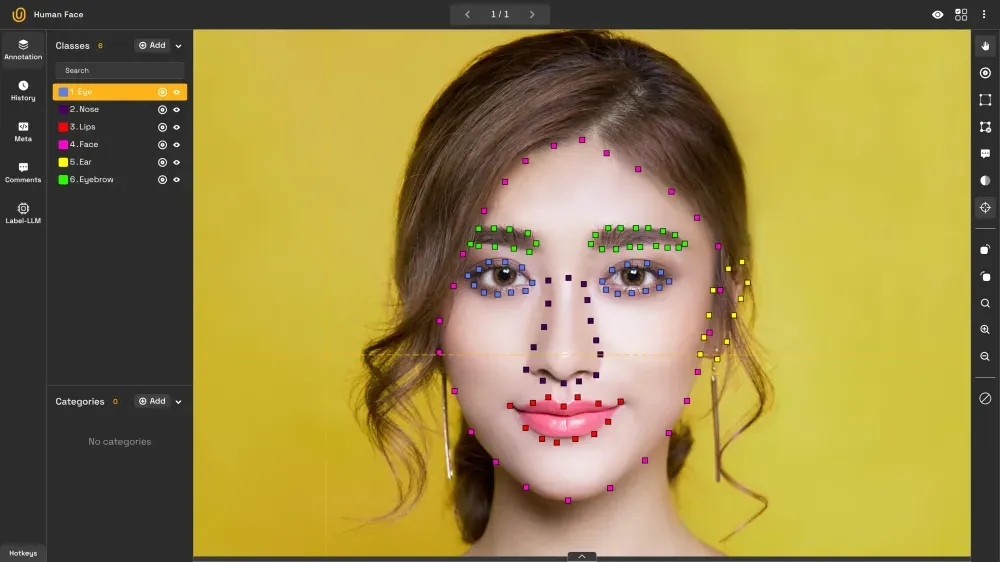

4. Fraud Detection with Face & Image Analysis

Insurance fraud siphons an estimated $308 billion a year in the United States. Eighty-five percent of carriers now staff dedicated anti-fraud teams, yet opportunistic schemes evolve constantly.

CV models tackle fraud on multiple fronts. Reverse-image search identifies recycled stock photos; forgery-detection networks expose cloned pixels and irregular compression artifacts; micro-expression analysis highlights fleeting facial cues often linked to deception in video interviews. Together with transaction-level anomaly scores (for example, three hail claims in six months, all filed at midnight), these tools form a layered defense that cuts fraudulent payouts without hindering honest customers.

5. Industrial-Risk Monitoring (AIoT)

Industrial machinery is expensive to insure—and even costlier to repair after a catastrophic failure. Cameras paired with IoT sensors create an “AIoT” safety net that spots trouble before it escalates.

CV algorithms watch for belt wobble, oil leakage, or missing safety guards; thermal imagers track abnormal heat signatures. When a threshold is breached, the system issues a preventive-maintenance alert, often days before a breakdown.

What is better than risk management, if there is no risk to manage in the first place? By shifting the insurer’s role from reactive to proactive, claim frequency and severity fall, and clients enjoy reduced downtime and lower premiums.

6. Underwriting Automation

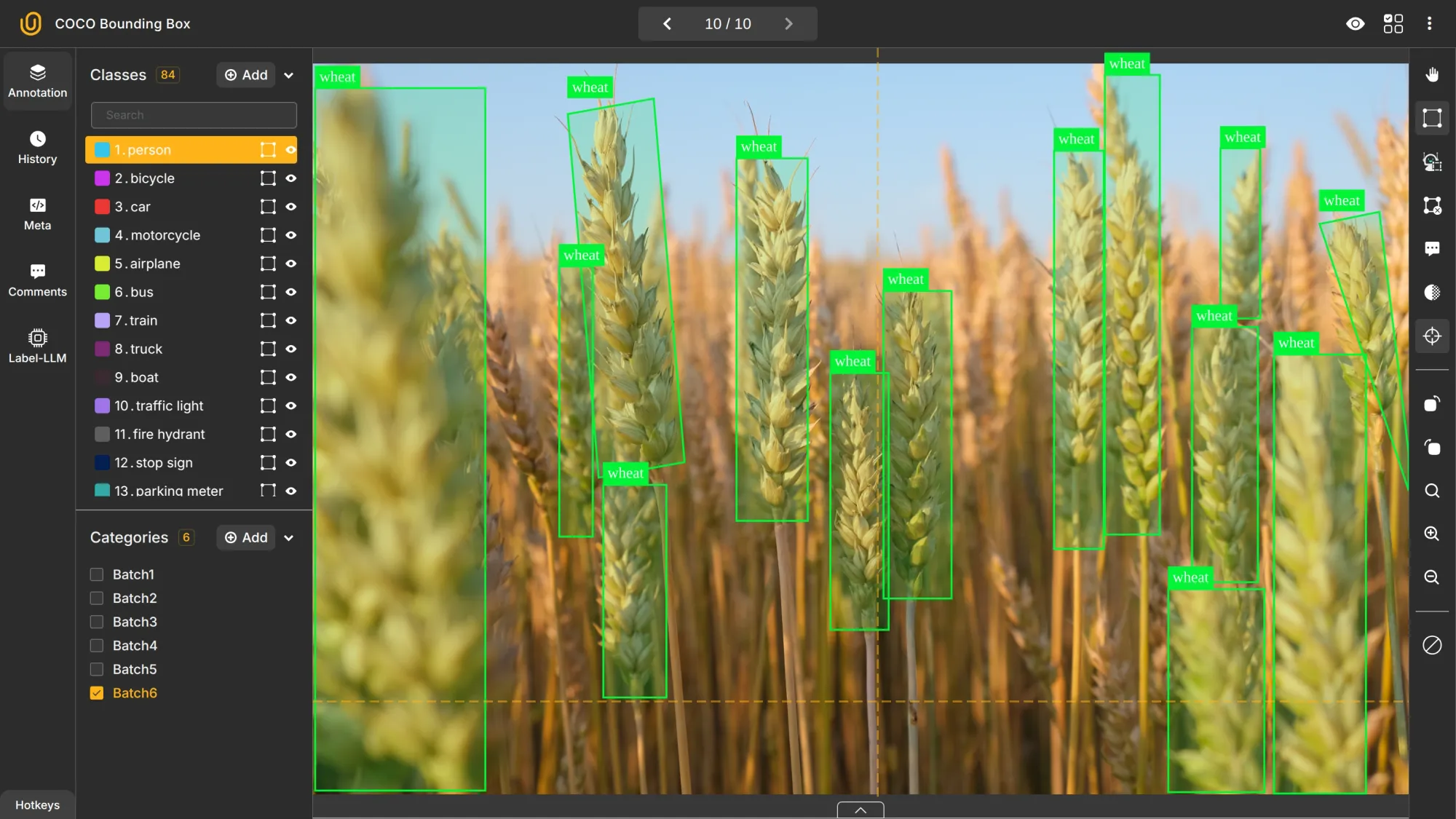

Underwriting converts raw data into a risk-based premium, but 80 percent of that data is unstructured text or imagery. Moving it between systems—and scrubbing it into a usable format—consumes a disproportionate share of analysts’ time.

Natural Language Processing extracts key terms from inspection reports, while CV classifies roof type, counts rooms, or estimates square footage from smartphone images. Clean, structured inputs feed rating engines directly, shortening quote-to-bind cycles and reducing “premium leakage” that occurs when risk details are missed or mistyped. The goal is not to replace underwriters, but to free them to concentrate on edge cases where human judgment adds the most value - the unification of man and machine.

7. Wildfire Risk Assessment

Wildfires cost the United States $400 billion – $900 billion annually, making precise risk scoring critical. Traditional models relied on coarse ZIP-code data; CV now refines analysis to the parcel level.

Multispectral satellite images quantify fuel load—dry brush, conifers, irrigated lawns—while digital elevation models capture slope and prevailing-wind corridors. A defensible-space classifier measures the gap between structures and vegetation. These features feed a dynamic hazard score that updates as conditions change, allowing carriers to adjust premiums, recommend mitigation, or decline coverage before the next fire season.

Conclusion

Computer vision has progressed from experimental pilots to mainstream deployment. Insurers already using CV across claims, underwriting, and fraud prevention report measurable ROI and a widening performance gap over slower adopters. As sensors improve and datasets expand, insurers that combine algorithmic speed with disciplined data governance and human expertise will lead the industry.

Explore More

Check out these posts for more on practical use cases of computer vision:

- Computer Vision in Healthcare: Applications, Benefits, and Challenges

- Computer Vision in Agriculture

- The Transformative Power of Computer Vision in Logistics

References

- Ulrik Stig Hansen (Jan 6, 2023). 6 Use Cases for Computer Vision in Insurance. Encord Blog: Link

- SuperAnnotate Staff (Mar 7, 2023). Top 6 use cases of computer vision in insurance. SuperAnnotate Blog: Link